-

SEBI Registered RA (INH000003507)

BSE Enlistment No:5203 - +91 9825663123

- support@abjfinstocks.com

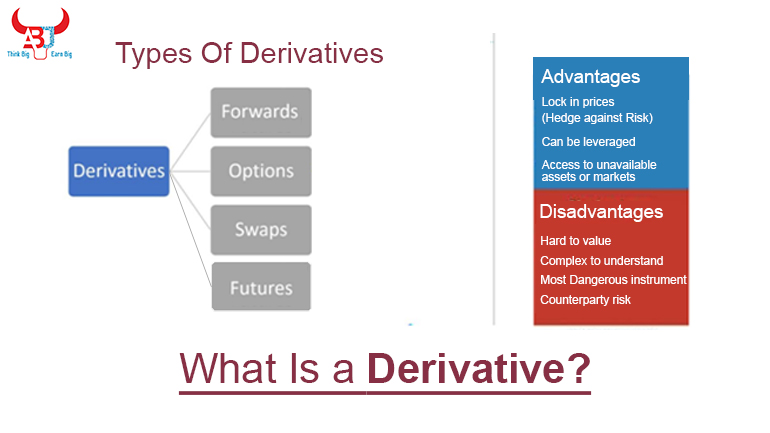

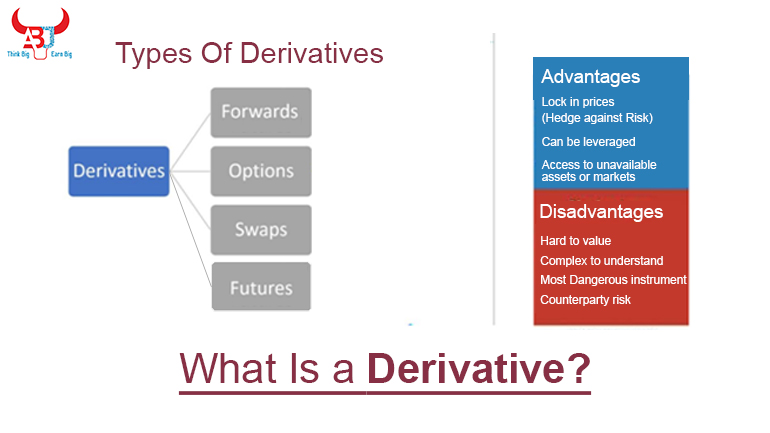

What Is a Derivative

A derivative is a financial product that has no value of its own. However, if you bought one and the price went up or down then you would make a profit or lose money. That is why derivatives can be a lucrative investment. Some people call them ‘betting on bets’ because they have no inherent value of their own but instead are betting on something else to perform.

A derivative is a financial contract that derives its value from the performance of an underlying instrument. For example, a stock option is a derivative because its value changes depending on how an underlying stock performs. You can think of derivatives as being based on another “underlying” or “host” asset. Derivatives can be used to hedge risks, speculate on price movements, and increase exposure to markets or assets without actually purchasing any of the underlying items. It’s important to note that not all derivatives are intended for hedging purposes.

Futures contracts are derivative products that allow a buyer or seller to exchange or trade financial instruments or physical commodities with any third party on an agreed-upon date in the future. Futures contracts are based on an underlying financial instrument, such as a security, an index, or a commodity, by referencing the price of the underlying financial asset. A futures contract is similar to an option contract because the holder possesses the right, but not the obligation of buying or selling an asset at a predetermined price.

Just like futures contracts, forward contracts involve the agreement to buy or sell a commodity at a set price in the future. A forward contract can be used for hedging or speculation.

Unlike futures contracts, a forward contract is a customizable derivative contract between two parties to buy or sell an asset at a specified price on a future date. Forward contracts can be tailored to a specific commodity, amount, and delivery date.Forward contracts do not trade on a centralized exchange and are considered over-the-counter (OTC) instruments.Financial institutions that initiate forward contracts are exposed to a greater degree of settlement and default risk compared to contracts that are marked-to-market regularly.

Options are a special type of contract that may or may not be exchanged for their underlying security at any time before their expiration (maturity) date. This means the owner of an option can do two main things with their contract: buy it back to end their option position, or exercise it to get the underlying security at a particular price regardless of the market value.

Options are among the most popular types of derivatives that traders can trade on. Options give you flexibility and the opportunity to control a portfolio of long and short positions.

A swap is an agreement between two parties, usually to exchange cash flows of one party’s financial instrument for those of the other party’s. It involves a series of payments over time. The parties take on the credit exposure, or risk of fluctuations in interest rates by entering into a swap agreement.

For example, some firms want to hedge against movements in interest rates, whereas others want to benefit from changes in them. So swaps come in many forms and are subject to regulatory supervision from organizations such as the Commodity Futures Trading Commission and Securities Exchange Commission.

There are several benefits that come along with investing in derivatives. For one thing, the ease in which one can purchase derivatives is a thronging aspect for many investors. Namely, derivatives are traded over the counter as opposed to traded on an exchange; which makes them a private and concealable industry.

In addition to this, there are several other advantages that are intrinsic to investing in derivatives, which includes: less regulation, leveraged trading among other factors. However, the disadvantages of derivatives over-weighs their advantages to an exponential degree. Therefore, it is a good idea to weigh both sides before initiating a trade.

One of the advantages of derivatives is it can lock in prices of stocks, indexes, commodities.

As an trader, you know that prices of some commodities can be more volatile in the market. The price of those commodities can go up and down quickly. This commodity value fluctuation makes you may get tremendous profit one moment, but lose a lot another time.

Like if we talk about commodities, with futures contracts, traders can lock in prices for commodities. When an agri manufacturer sells a futures contract of its products, he or she locks in a price for their future commodity needs. If the price goes up, so does the cost of the contract, but if it goes down, it costs less to fulfill your needs. Like we can use futures in stocks and Indexes.

Investors can hedge against risk by buying derivatives. For years, derivative contracts have been used to hedge against the risk of things like fluctuating currencies, movements in interest rates, and commodity prices. When an investor puts on a trade to hedge against these risks they are technically hoping the underlying asset price goes up or down in value as little as possible. Investors use this form of hedging because it is cheaper than shorting the stock outright.

One of the best things about derivatives is that they are very flexible instruments that can be leveraged, making your money work hard by multiplying your gains and losses both. Derivatives are used to get easy leverage. You can buy futures of stocks if you just have margin amount that would not be possible in the cash segment, in the cash segment you would have required full amount to take the delivery of the said stock for a short term.

Access to unavailable assets or markets:

It is difficult to have direct access to every asset or market. Derivatives can help you in gaining access to all such unavailable assets and markets. You can use interest rate swaps and obtain much more favorable interest rates relative to interest rates available for direct borrowing.

One of the big disadvantages of derivatives is that they are hard to value. Derivatives often have no “real” value, and instead their price depends on how you or other investors assign value to them. Many factors go into valuations of derivatives and so its pricing is risky and difficult to assess.

In the financial world, derivatives are fairly common. They can be traded on exchanges and are used to deal with the risks of underlying securities. However, they are a bit complex to understand which is why many traders choose them based on advice from an expert. The concept of derivatives is complex to understand, and many people in the market (including the majority of finance professionals) don’t really comprehend what it is. This can be dangerous for participants who use it without understanding it deeply.

The most dangerous instrument must be the derivative one, at least when it is not understood and managed with care. Actually, the most harmful instrument is the one that can be used in the wrong way, or by someone who doesn’t own it and knows how to use it in the right way.

Counterparty risk

Although derivatives traded on the exchanges generally go through a thorough due diligence process, some of the contracts are traded over-the-counter. Thus, there is a possibility of counterparty default.

Multibaggers.co.in has the best intraday advisor in India and stands tall among the trusted advisors to trade in the stock market. With the wide experience of more than 12 years, we are creating waves with their service and loyal customer base. We have been working very closely with their clients over the years and promise to help them find satisfactory solutions to problems that they might face while trading in the Indian stocks market.

The stock market is one of the best places where people can put their money to work. However, it is a very dynamic place and there is surely no easy way to earn money here. Multibaggers.co.in provides stock market courses so that you can learn some skills that will make you profitable in the stock market. Our comprehensive course covers almost everything you need to know about stock trading. You can learn the art & science of trading using stocks, indexes with us. We even teach derivatives courses to make you understand all these things in detail and how to practically use derivatives to make money and reduce risk.

We have created a unique concept in the field of stock market education by bringing together multiple strategies that have been used successfully by the top traders and fund managers of the world. We aim to make the complex process of investing in stocks easy to understand and implement by giving our readers all information required to start investing in stocks easily and know the best stocks to buy. Our main aim is to motivate people and companies to do their own stock analysis and use their financial freedom gained by doing it.