-

SEBI Registered RA (INH000003507)

BSE Enlistment No:5203 - +91 9825663123

- support@abjfinstocks.com

Value vs. Growth Investing

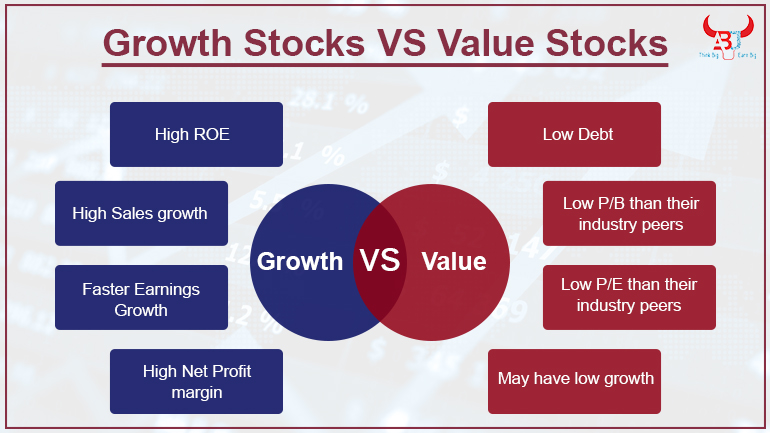

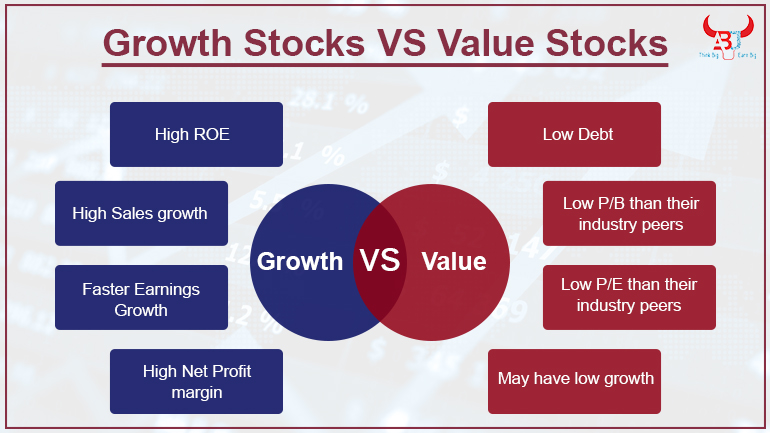

When you are investing in the stock market, it’s important to remember that there are two types of investing strategies: value and growth. Value investing is focused on finding stocks that are cheap relative to a company’s earnings or assets, while growth investing is focused on finding companies that are going to outperform. You can’t talk about value and growth investing without first defining what it is. Value investing is a strategy that focuses on investing in companies that are undervalued relative to the intrinsic value of their stocks. Growth investing, on the other hand, is a strategy that focuses on stocks that are expected to grow at a faster rate than average.

Growth investing has historically beat value investing and index investing. In growth investing, stocks are bought because of the high growth like Multibagger stocks. The investor looks for companies that have high growth prospects and can give a good amount of return as compared to its competitors.

The basic idea is to buy well-researched stocks that are under-priced, which offer great Margin of Safety. A margin of safety (MOS) is the difference between the Current Stock price and the intrinsic value. The “value” in value investing comes from deep analysis of businesses, using profits and discounted cash flow models, taking future growth expectations into account. The goal is to buy businesses that have a good earnings record and are not valued at a ridiculously high price relative to its worth.

A growth fund is a fund that invests primarily in equities with above-average earnings growth and below-average market capitalization. Unlike growth companies, value companies are generally mature companies whose fundamental values are higher than their share prices. The goal of a growth fund is to grow aggressively by investing in high growth companies. A growth fund tries to achieve its investment objective through active management of the portfolio. Growth funds can be categorized by the size of the company or by their market cap, as well as by their country or region.

The term “growth stock” has lost much of its original meaning in today’s market. Everyone uses the phrase and applies it in different ways. A Growth Stock is typically understood to be a stock that shows strong earnings growth. But this is too vague when applied to individual stocks.

A growth stock is a stock that has high earnings growth and high price to earnings (P/E) ratio, which means it is trading at a higher multiple of earnings than other stocks out there. The market price of the stock represents the value of all future earnings yet to come if the company continues performing in its normal way.

The first thing to look at is the return on equity ratio, which is one of the primary ratios used to measure corporate profitability. This is the amount of money a company makes after all expenses, divided by the amount of capital that was used to generate this income.

Any company with a stronger return on equity receives more money in the form of profit for each rupee invested by investors. They therefore have more funds that they can use to grow their business and are more likely to do so than weaker companies.

Profit margins are a great way to quickly determine which companies are likely to have superior growth. Specifically, we want to know if the net profit margin has been stable or growing consistently over the last 3-5 years and how sensitive it is to a strong or weak economy. Surprisingly, these factors tend to be well ignored by analysts looking for “new” growth stocks. But we can use them instead as a gauge for future growth potential.

Growth in earnings is nice, and growing profits are even nicer. But the single best thing to look for when assessing a growth stock is profitability. Companies can be profitable without growing earnings, but of all the things that can go wrong for a company, unprofitability is what puts it most at risk for danger.

Earnings growth can be a crucial factor in the stock market and identifying companies who are experiencing earnings growth can be quite useful. Earnings growth is typically an integral part of a company’s performance, and a vital driver for growth stocks in general. When you step back and take a look at some of the largest out-of-this-world gains in retail stocks over the past decade or so, it’s clear that top line revenue growth is vital to success as a long-term investor.

There are companies on the stock market that go up in value, and there are companies that go down in value. Some people buy shares in companies they like, others buy several different types of shares and decide later which ones they like and which they don’t. But how do you spot a value stock?

If you’re a value investor, it is important to know how to spot value stocks. When you find a great company, that helps your portfolio but it also gives you confidence – knowing that you aren’t going to lose your shirt on a bad investment. There are actually quite a few indicators that can be used to determine if a stock is undervalued.

Value investors should look for companies that have relatively low debt. Debt can come in many forms. Low debt is a sign of a strong cash flow and a clean balance sheet. Debt isn’t inherently bad, but it’s important for investors to gauge the leverage health of companies.

The most defining quality value investors look for is the price-to-earnings ratio (P/E). A high P/E means you’re paying much more for a stock than its peers. Value investors want companies that are selling at a lower P/E than their competition, since it would suggest that it’s one of the more attractively priced stocks available, and so looks like a bit of a bargain.

Low P/B than their industry peers is something that value investors look for when investing in companies. This means looking at the company’s share price along with its book value per share. It’s a quick and easy way to see whether or not a company is undervalued and could be worth investing in.

Value stocks may or may not have a good growth story but they are consistent cash cows with huge market share. These stocks may grow slowly over a long period of time. These stocks may not over perform the market but will give safe and respectable returns over a period of 10 to 20 years.

Whether you’re searching for growth or value stocks, multibaggers.co.in can be a great resource. Having a diverse portfolio and regularly researching investment opportunities is key to growing your net worth over time. We are a leading SEBI Registered stock advisory and provide our investor clients with the world’s most diversified portfolios. We have created exclusive portfolios and stock trading courses to cater to the trading needs of different types and sizes of investors, in sync with the requirements of both traders and investors and based on their preferences.

There are many successful growth and value investors. Still, both growth and value investors have lost money with investments that go in and out of favour. The approach that’s right for you is up to you. It is also important to consider the current market situation, your risk profile, financial goals, and the time horizon for your goals. An investor should diversify their portfolio by investing in both styles of investing. Remember, a stock cannot remain a Growth or Value pick forever.

Growth stocks are an exciting thing to watch because you can make huge gains from relatively small initial investments. As a value investor, this can be very frustrating because you do not really have the same growth as a growth stock. However, where we think value investors do better is in dividend stocks. Dividend stocks still offer the safety of the price of the stock staying the same or going up but with the wonderful addition of being paid through dividends. Growth Stocks make early investors rich and Value Stocks are good for dividends.