-

SEBI Registered RA (INH000003507)

BSE Enlistment No:5203 - +91 9825663123

- support@abjfinstocks.com

ABJ FINSTOCKS provides Swing Stock Calls tips for 10-15 days

We follow diversification approach to generate good profits for Swing Trading Stocks

with our time tested strategies.

Diversification is done over stocks and strategies both for generating swing trading tips.

Years SEBI Registered

Years Experience

We are growing fast, with the growth of our clients, as Swing Trading advisor.

ABJ Finstocks is a SEBI registered Research Analyst.

As a SEBI registered Research Analyst, we pride ourselves on our Experience, Transparency, and Client-centric approach.

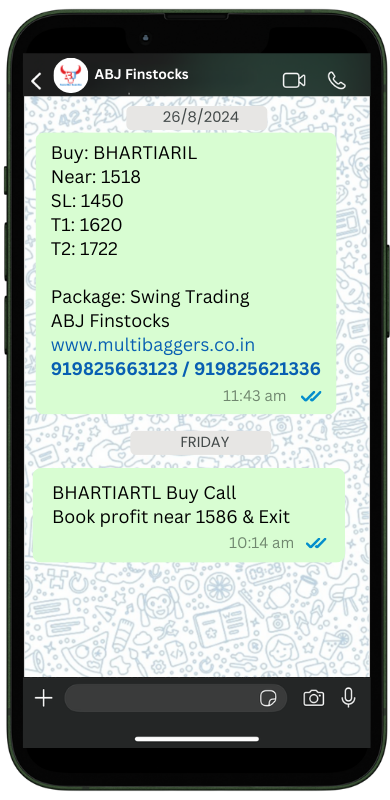

| Swing Trading Stock | |

|---|---|

| Types of Trades | Only Positional Buy Trades |

| Type of Stocks | Diversified in Small, Mid and Large Cap, all Stocks |

| Time Frame | 2- 15 Days |

| Number No Of Calls | Minimum 8-10 Calls in a Month Avg. 10-15 Calls per Month |

| Minimum No OF Calls Per Month | 8-10 |

| Stop Loss | 2-6% |

| Target | 2 Targets 4-20% |

| Reward: Risk | Reward: Risk: Avg. 2: 1 |

But we cannot showcase past performance as not allowed by SEBI.

Free Trial OR Demo is Neither a genuine Practice going on as we are all aware about it, Nor its fruitful as 1-2 days not sufficient to Judge Returns.

ABJ Finstocks is a SEBI registered Research Analyst since 8 Years.

Our Success is Your Renewal, we believe in long term Relations.

We have good renewal Ratios in both Trading as well as Investments advisory.

No Fake Commitments, No Cheating, We Walk what we Talk, We Talk Only Practicalities.

Since 8 Years Zero Onboard of Complaints on SEBI Portal. You can check SCORES.

World Wide Trusted Clients Across Countries

In one line: Catching the upward stock price momentum in minor trend.

There are three trends in the markets. The first is the Primary, then the Intermediate trend & the last is the Minor trend. This minor trend is nothing but a momentum in a stock price which on an average last for 5-15 days. These moves could be from 5% to 20% of stock price and can be caught by using technical Analysis parameters.

To take benefit of it this minor trend, we provide swing trading tips.

Yes, here in swing trading tips, we have just focused buy positions so that small traders can also take benefit of it. For Sell trades we have to make positions in Futures which required huge capital. Trading in cash makes our risk management in our hand.

Above was about risk part, now for returns. For good returns we insist you to subscribe for at least 6 months. You can initiate with 1 month Package for getting idea of how we work. But go for minimum 6 Months service later because we need minimum 60 calls to deliver you good returns on your capital.

Earning in stock market is not about just good calls but a minimum good number of trades to give you good ROI.

Yes, Swing trading is more profitable than day trading.

The riskier the trade, higher is the return.

Though we are many times correct with proper trades, intraday trading doesn’t give us profit it may not move the same day but this is not the case with swing trading.

But there is always risk of gap down open in Swing trading that intraday traders don’t face.