- SEBI Registered RA (INH000003507)

- BSE Enlistment No:5203

- +91 9825663123

- support@abjfinstocks.com

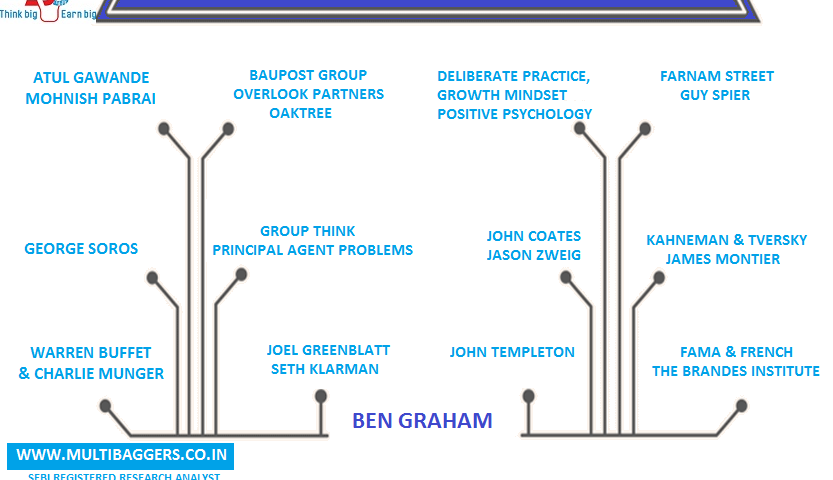

The Value investing family

Value investing is an investment model which involves buying undervalued securities. The securities whose market price is lower than its intrinsic value are undervalued securities. In simplest forms buy the security with highest margin of safety.

Margin of safety= Intrinsic value- Market Price. The lower the market price compared to intrinsic value higher will be the margin of safety. The intrinsic value is the discounted value of all future distributions. However, the future distributions and the appropriate discount rate can only be assumptions.

Long term Investment in value stocks involves lower risk and higher returns as strong scrip’s are bought on lower side. Earn more than 100% returns in 2-3 years with Multibaggers.co.in i.e. money doubles every 2-3 years. Stocks are analyzed and carefully chosen by SEBI registered Research Analyst.

When Nifty climbed by 29% (since 2017 end), our stocks invested on Value investing concept shoot up NEARLY 100% within a time span of nearly 15 months.

Titan acquired after 33% dip near 300, reached 1st target near 600, doubled money

NIIT Tech acquired after 39% dip near 385, again 100% up i.e. doubled money near 770

Divis lab acquired after 39% dive near 597, up 100% near 1194

Mind Tree acquired after 43% slump near 459, that too up 100% i.e. 918

This is just a glimpse of actual performance of multibaggers.co.in

Value investing was established by Benjamin Graham and David Dodd, It was followed by Buffet and many more after that. Graham never used the phrase, “value investing” — the term was coined later to help describe his ideas and has resulted in significant misinterpretation of his principles, the foremost being that Graham simply recommended cheap stocks.

Value investing is opportunity for smart people when weak; indiscipline public runs away from stock market. Till market rises, traders feel great about their trades but as market reverses back down it starts fear and if fall is chronic public ends up in panic selling with a determination to leave market forever. This paves the way for smart money as that is opportunity of value investing which stimulates bounce back after the exit of general public and this never-ending cycle of Stock Market goes on and on…