-

SEBI Registered RA (INH000003507)

BSE Enlistment No:5203 - +91 9825663123

- support@abjfinstocks.com

Share market or share bazar or satta bazar are terms which are associated with the stock market in India.

Share market or share bazar or satta bazar are terms which are associated with the stock market in India. Share market refers to the stock market that focuses on trading in shares belonging to companies.

Satta means speculation. Speculation involves trading in stocks with amounts involving high risk, in expectation of significant returns. The motive of traders is to take maximum advantage from fluctuations in the market.

Share bazar is called a satta bazar because more than 90% of the traders are involved in it with no clear calculations and analysis with the goal of getting quick rich. However, the irony is that they lose all capital very fast and the public that has patience that is actually less makes more money.

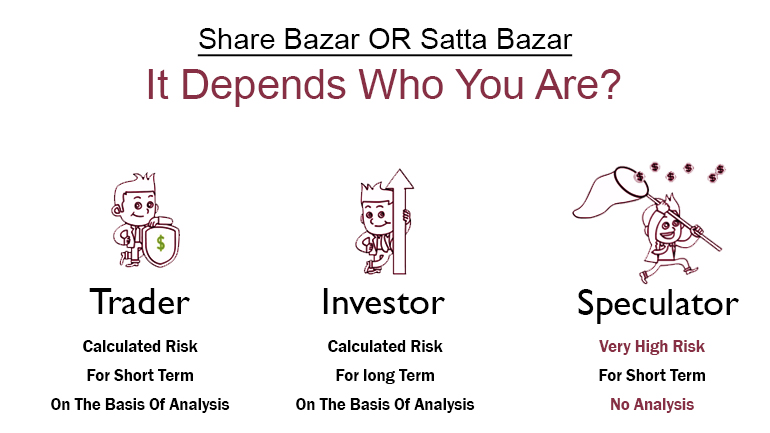

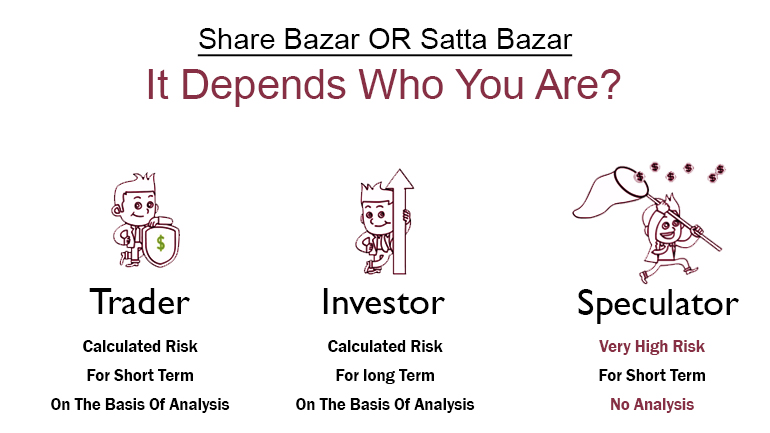

To understand it better, let us understand three terms: Trader, Investor and Speculator. Three things separate all 3 categories, Duration, Risk and Analysis.

“Trade duration” can be explained as the length of time you look to hold on to your trades. It is determined based on a variety of personal factors and strategies and is dependent upon your own risk profile, time horizon and market analysis. IT can be long term, short term or intraday.

RISK

Risk is the loss for traders. Risk comes under the Risk management part. the majority of the market participants forget to consider the risk part of trade while entering the market. Trading without any risk management is risky for both novice traders as well as professionals.

ANALYSIS

Trade analysis, in the stock market, incorporates diverse means to predict whether the stocks will go up or down. It can be done through different factors such as market trends, economic analysis, company analysis, etc.

A trader is someone who attempts to make profits from buys and sells of various stocks or indexes over a period of time in the stock market. Traders are the lifeblood of the equities markets, traders can be individuals or organizations. Traders know very well what is the risk they are betting and have all their calculations very clear. Traders enter in trades after proper analysis and not just on the basis of gut feel.

An investor is a person who makes investments in different assets with the hope of getting a high return over a longer time period, maybe more than 3-5 Years. Investors take calculated risk for the long-term on the basis of analysis. Their decisions are based on proper analysis and they don’t enter any stock just on gut feel or the new os TV. Many times they may not analyse themselves but make their portfolio based on the suggestion of an Investment advisor or research analyst but one thing is sure they don’t bluff their investment decision. They make huge wealth because of good analysis, proper money management and long term holdings.

Like traders, speculators also attempt to make profits from buys and sells of various stocks or indexes over the period of time in the stock market. A speculator is a person who takes over risks in anticipation of profits but doesn’t create anything. In fact , their losses make money for traders and investors . In the stock market, speculators are known as the people without knowledge about theTechnical or fundamentals of stocks they trade. What differentiates traders and speculators is the risk they take and the base of analysis on which they enter into trade.

It takes time to be a professional trader. However, people enter the market without learning and want quick money. They always have some fantasy about shortcuts and luck, but there is no such thing. First, you must be aware that it takes time to become a professional trader. You cannot earn big money with just one single trade. If you are not patient enough to work as a trader, please do not enter into this field. You can know more about stocks investment duration through our article:

One of the most important factors for achieving long-term growth in the share market is making a calculated decision at the right time by analyzing various parameters. While doing so, any change in global markets, any new government policy or court ruling on demonetization coupled with other local factors can have a considerable effect on the performance of your portfolio. We recommend that you should check individual stock performance regularly to understand why your investment is performing well or not over time. Hence, we have provided you with the best stock market advisor in India to help you make better-informed decisions.

Multibaggers.co.in is SEBI registered advisory in India, they provide best stock market tips and tricks by highly experienced experts. We have professionals who have years of experience and put their extensive knowledge to work for you. All you have to do is sit back and relax while our strategies bring you success!