-

SEBI Registered RA (INH000003507)

BSE Enlistment No:5203 - +91 9825663123

- support@abjfinstocks.com

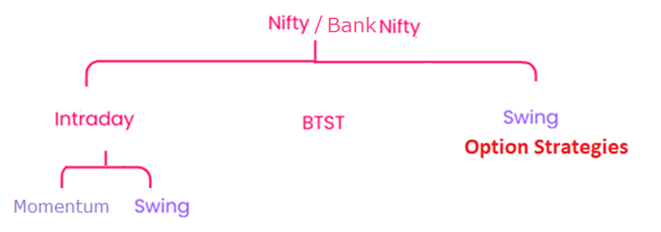

ABJ FINSTOCKS provides Futures & Options F&O tips .

We give Intraday+BTST+ Positional calls and puts tips

In Intraday we follow Momentum approach in Options trading with our time tested strategies.

| Details | Intraday (Momentum) | Intraday (Swing) | BTST | Positional (Swing) |

|---|---|---|---|---|

| Buy / Sell |

Only Buy Bearish: PE Buy Bullish: CE Buy |

Buy + Sell (2 Positions at a time) |

Only Buy Bearish: PE Buy Bullish: CE Buy |

Buy + Sell 2 Positions at a time |

| Hedge | NO | Yes | NO | Yes |

| Time Frame | Intraday | Intraday |

Entry: Near Close Square Off: Next day |

1–10 Days |

| Number of Calls |

Generally 1 Call/Day (20–22 Min p.m.) |

No Daily Call 6–8 Calls p.m. |

No Daily Call (8–10 Min p.m.) |

No Daily Call 4–8 Calls p.m. |

| Funds for Demat |

Minimum 2 Lots ITM Options as 2 Targets (Confirm with your Broker) |

Nearly 70% of Future Margin |

1 Lot ITM Options Premium as 1 Target |

Nearly 70% of Future Margin |

| Intraday Index Options | BTST Index Options | Swing Option Strategies | ||||

| Package | 1st Nifty Intraday | 2nd Bank Nifty Intraday | 3rd Nifty BTST | 4th Bank Nifty BTST | 5th Nifty Option Strategies | 6th Bank Nifty Option Strategies |

| Trade will be in | Options | Options | Options | Options | Options (2 Positions at a time) |

Options (2 Positions at a time) |

| Trade Type | Only Buy (Call OR Put) |

Only Buy (Call OR Put) |

Buy OR Sell (Call OR Put) |

Buy OR Sell (Call OR Put) |

Buy Or Sell Both Possible | Buy Or Sell Both Possible |

| Hedge | NO | NO | NO | NO | Sometimes | Sometimes |

| Time Frame | Intraday Calls | Intraday Calls | Entry: Near Close of the day Square Off: Next day |

Entry: Near Close of the day Square Off: Next day |

2-10 Days | 2-10 Days |

| Number of Calls | 1-2 Calls per Day (20-22 Min. p.m.) |

1-2 Calls per Day (20-22 Min. p.m.) |

1 Call per Day (8-10 Min. p.m.) |

1 Call per Day (8-10 Min. p.m.) |

4-8 Calls p.m. | 4-8 Calls p.m. |

| Stop Loss | 20-50 points | 50-100 points | 50-100 points | 100-300 points | 80-120 points | 200-400 points |

| Target | T1: 20-50 Points T2: More 20-50 Points |

T1: 50-100 Points T2: More 50-100 Points |

Only T1 Near 50-100 Points | Only T1 Near 150-350 Points | T1: 80-120 points T2: More 80-120 points |

T1: 200-400 points T2: More 200-400 points |

| Details | Intraday Nifty (Momentum) | Intraday Nifty (Swing) | BTST Nifty | Positional Nifty (Swing) |

|---|---|---|---|---|

| Stop Loss | 20–50 points | 40–100 points | 50–100 points | 80–140 points |

| Target |

T1: 20–50 Points T2: More 20–50 Points |

ONLY 1 TARGET: 40–100 points |

ONLY 1 TARGET: Near 50–100 Points |

ONLY 1 TARGET: 80–140 points |

| Details | Intraday BankNifty (Momentum) | Intraday BankNifty (Swing) | BTST BankNifty | Positional BankNifty (Swing) |

|---|---|---|---|---|

| Stop Loss | 50–100 points | 100–300 points | 200–400 points | 300–500 points |

| Target |

T1: 50–100 points T2: More 50–100 points |

ONLY 1 TARGET: Near 150–300 Points |

ONLY 1 TARGET: Near 150–350 Points |

ONLY 1 TARGET: 200–400 points |

But we cannot showcase past performance as not allowed by SEBI.

Free Trial OR Demo is Neither a genuine Practice going on as we are all aware about it, Nor its fruitful as 1-2 days not sufficient to Judge Returns.

| Intraday | BTST | Swing Option Strategies |

|---|---|---|

|

Generally 1 Call Opening Market Calls are Provided Momentum Calls Stop Loss Modified to Reduce Risk 2 Targets are Provided |

Daily Calls Don’t Come Calls are Provided Near 3:15 Square Off Generally in Opening Market Single Target Provided |

Daily Calls Don’t Come Calls are Any Time During Market For Good Move Single Target Provided |

| Working Method | ||||

|---|---|---|---|---|

| Intraday | BTST | Swing Option Strategies | ||

| Generally 1 Call Opening Market Calls are provided Momentum Calls Stop Loss Modified to Reduce Risk 2 Targets are Provided |

Daily Calls Dont Come Calls are Provided Near 3:15 Square off generally in Opening MKt Single Target Provided |

Daily Calls Dont Come Calls are any time during Market For Good Move Single Target Provided |

||

Years SEBI Registered

Years Experience

We are growing fast, with the growth of our clients, as F&O advisor (Research analyst).

ABJ Finstocks is a SEBI registered Research Analyst.

As a SEBI registered Research Analyst, we pride ourselves on our Dedication, Transparency, and Client-centric approach.

No, Option strategies help you make Money even if there is no momentum in Market.

Yes, combo rates would be applicable on selection of more than 1 Package be it any Package , pricing details are given below of single and Combo Packages.

ABJ Finstocks is a SEBI registered Research Analyst since 2016.

Our Success is Your Renewal, we believe in long term Relations.

We have good renewal Ratios in both Trading as well as Investments advisory.

No Fake Commitments, No Cheating, We Walk what we Talk, We Talk Only Practicalities.

Since 8 Years Zero Onboard of Complaints on SEBI Portal. You can check SCORES.

World Wide Trusted Clients Across Countries

Registered with SEBI as Research Analyst in 2016 and following all the guidelines Specified.

Our whole work, selecting stocks and dealing with clients, everything is done honestly and in good faith.

All stocks are Recommended after proper analysis and due diligence

To increase our business revenues we don’t give any commitments regarding returns OR capital protection in any of our packages. Though we have track record of good performance.