- SEBI Registered RA (INH000003507)

- BSE Enlistment No:5203

- +91 9825663123

- support@abjfinstocks.com

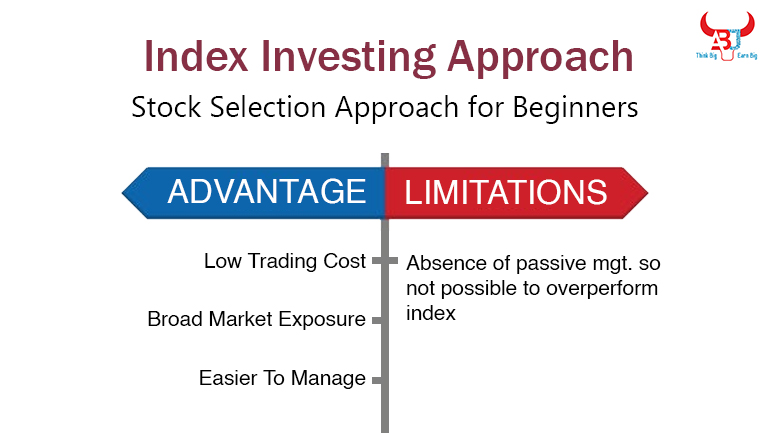

Index Investing Approach: Stock Selection Approach for Beginners

The stock market has seen substantial growth and success over the past several years. Only a few of the investments have given great returns such as the stock market. It’s safe and good, as a beginner, you should begin your journey through index investing along with educating yourself on the basics of best stocks to buy, stock selection and investing strategies. Stock selection plays an important role in determining the success or failure as an investor.

Meaning

Index investing is a passive investment strategy that seeks to replicate the stocks and returns of a benchmark index. Make the portfolio the same as an index. Most preferable index in India are Benchmark Index i.e. Nifty 50 and Sensex 30. Indexing is a passive investment approach that seeks to provide returns similar to those of a specific market or the entire stock market.

Complete index investing involves purchasing all of an index’s stocks with the same weights as it is in the original portfolio. Incomplete index investing involves purchasing most, but not all of an index’s components at their given portfolio weights. We recommend doing Index Investing and not to involve your brains for making a portfolio.

Index Investing is a buy and hold approach, if the index composition is changed then only you have to trade or incase of dividends you have to reinvest. Therefore, it provides broader diversification and thus lower portfolio turnover cost, as an investor does not need to actively trade these stocks.

When you invest in an equity index, you get broad market exposure. For example, if you invest in Nifty Stocks then your portfolio would be diversified into Metal, healthcare, Refining, Auto, etc companies that are included in Nifty, and would be an efficient portfolio. When one sector is falling, others may be rising.

Compared to active investing, passive investing is much easier and more convenient to start with and manage. This is because you are going to have no headache left for stock selection which is a tricky job in the market and no software needed for tracking portfolio performance.Shareholders just need to monitor dividends received,as they enjoy the benefit of dividends, from the companies they own stocks in.

So Passive investing is less time consuming, investors would be free to spend their time doing other things that are more important than researching and monitoring companies in the stock market Portfolio. When you own stocks of a company, you have a responsibility to keep up with its developments, as it has become part of your financial viability as well as your family’s.

Index investing is not only about the positive side, the hardest limitation is, it cannot overperform the Market. Even though it is a great concept of investing, where you buy a basket of stocks and then forget about it. It is said that the reason this approach works so well, because an index investing generally holds all the stocks in the market at all times. But unfortunately, you cannot beat the market through an index investing approach. Due to the absence of stock selection that is in the growing stage it is not possible to over perform index.

Expert Advice

For an over performing portfolio you can invest in our Multibagger stocks i.e. growth stocks portfolio. Here at multibaggers.co.in we provide long term stocks of two types: growth stocks and value stocks. We encourage investors to own both kinds of stocks because they bring in different types of returns depending on the developments at the company.

Conclusion

Another easiest way to find the best stocks for investment is through an Alternative Investment Approach which says to invest in stocks for your portfolio of the companies that give you other investment options like Gold, Fix Deposits, etc. We have already discussed this topic in one of our articles: Alternative Investment Approach: One of the easiest ways to select Best stocks.

It is very simple to make a portfolio without a portfolio manager. Indexing offers greater diversification. Indexing investing is a great way for beginners to invest and build wealth.The index investing approach is definitely more suitable for beginners as it gives out less room for error and mistakes which do not occur as frequently in individual stock picking. You can also take our stock trading courses to know more about trading and investing.