- SEBI Registered RA (INH000003507)

- BSE Enlistment No:5203

- +91 9825663123

- support@abjfinstocks.com

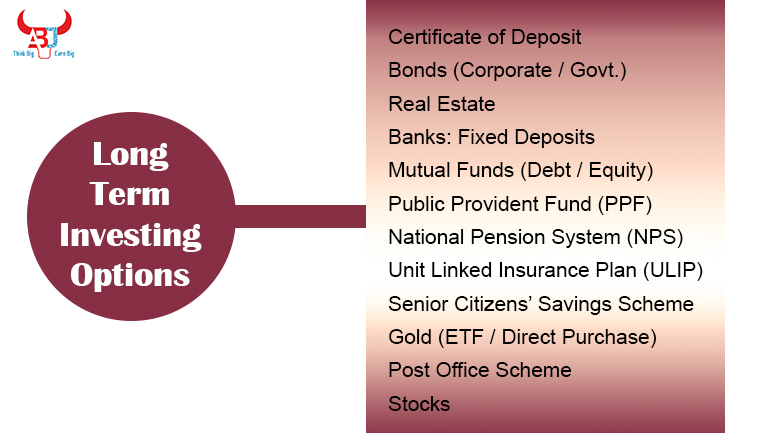

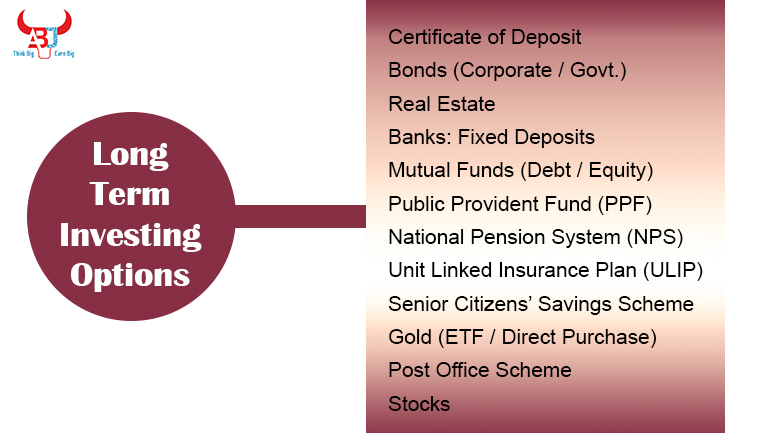

There are different options available for long term Investment in India

When you are thinking about investing your hard earned money, there is always a chance that you may lose it all. Investing is not something that is done only by people in high-income groups. There are different forms of investing and each one offers different rates of return along with risks involved. When it comes to long term investing, the most common forms are described here for everyone. Multibaggers.co.in is a leading platform providing stock investment advisory services for long term investment.

A plan is only as good as the amount of time it has been in existence. It means the more distant you are from your investment horizon the more returns you can get.

A long-term goal is something that takes time to achieve. It is a plan or a schedule on how to achieve your future goals. A long-term goal could be a retirement, a house of your own, starting your own business and many more. In this article, you will discover different investment options for achieving your long-term goals.

As a long term investor, you are less concerned with how stocks and bonds perform on a day to day basis, but more concerned over how they will perform over the long term. Long-term gains are the objectives of people who are in it for the long haul. Let’s take a brief look at long term investment options.

Bonds are a special type of investment that pay a reliable, stable rate of interest as well as return your original investment when the bond reaches its maturity. Bonds have become more popular in recent years as investors look for alternatives to stocks and other investments. Bonds are a type of debt owed by governments or companies. They are typically issued with a set maturity date and interest rate. Buying bonds offers steady returns, as the issuer has to pay you back over time.

The good thing about bonds is that they are predictable and you will get your money back at the end of the day. There are different types of bonds like treasury bonds, corporate bonds and municipal bonds etc, which vary in risk levels.

Large corporations issue corporate Bonds. They are often a safe investment option for people who just want to make money. A corporate bond is essentially an IOU that a company will pay back with interest (that’s the juicy part for you). The company has the responsibility of paying the interest and meeting its obligations.

Corporate bonds are issued by companies in order to find the funds they need for different business purposes . Corporate bond yields, to a certain extent, function as the interest rate at which investors can lend money to corporations. The prices of corporate bonds are affected by numerous factors, with the most important being inflation and interest rates.

Government Bonds are just like any other bonds, which are financial instruments used to raise money from the public for a period of 20-30 years. It is the debt issued by the government agreed by the public.

The government invests in projects with a long time horizon that may require huge funding. The bonds issued by the government have long term maturity. They are less risky because there is no threat of default.

Real Estate is one of the best investments that anyone can make for their financial future. It is something that has been around for a long time and will continue to be an important asset to people when it comes to making money. This is because the demand for property will always be high.

Real estate investment is the best investment for the future. With the passage of time, real estate prices increase, interest rates also decrease and so with the passage of time as well as rate of interest decreases and hence the opportunity to buy a property becomes less. Putting resources into a roaring area like real estate is one of the tried and true best long investments that require colossal capital at first yet is ensured to get you monstrous returns whenever held for a more drawn out term. One can hope to put resources into plots, houses, farmhouses, plugs, lodgings, cafés, and so on.

Banks provide a range of investment options for common people to save their money. Such investment instruments are extremely useful for investors in need of fixed income, especially considering the low interest rate scenario. Despite having low profitability as compared to other investments like shares or debt, investments through fixed deposits (FDs) are still attractive as they have several advantages and tax benefits.

This is the most conventional type of investment in India when there were very few choices. The decent stores presented in banks are viewed as the most secure, where the sum can be contributed for more broadened periods, for example, three or five or even ten years for a proper pace of return that reaches between 3% to 6.5% per annum. When the term closes, it is accessible for withdrawal.

Mutual Funds is a collective investment scheme, which is a pooling of funds collected from many investors who invest in the common fund managed by professional asset managers to capture the returns of securities markets or foreign currency markets or commodities markets or interest rates market or any other market.

Mutual funds can be considered as a form of collective investment scheme where a number of investors pool their money together to create a portfolio that would invest in stocks, bonds, and other securities.

The debt mutual fund is a form of mutual funds that has become popular in recent times. It can be used for different purposes and the fact is, you can use it just as well as the equity mutual funds if you plan your strategy correctly. The best investments for your long term wealth building are debt mutual funds. Debt mutual funds can get you higher returns with less risk despite being lower risk than equity.

An investment into an Equity mutual fund generally is meant to be a long term investment. It is essential that the investor in such schemes should have a clear idea about his investment objective and this objective should be matching the overall portfolio he has.

Equity Mutual Funds have been earning higher returns than many other asset classes for a long time. However, equity mutual funds can be risky and volatile. So study diversification in equity mutual funds before investing your hard-earned money.

The Public Provident Fund is the ideal option for long term savings. It is backed by the Government of India, and has very low risk involved. The rate of interest that is offered on PPF is the lowest among all types of investment instruments, which makes it suitable for everyone to invest.

It has a tenure of 15 years and can be opened for any number of years in multiples of 1 year. This is like the Employee Provident Fund (EPF) given to salaried people, however the main distinction is, anybody can open PPF. The current rate of return is 7.1%, which is consistently fixed by the Government.

The National Pension System is a social security scheme launched by the government of India. The scheme was started to invite the people of India to invest their hard earned money in various financial instruments like equity oriented funds, debt oriented funds, balanced funds and many more.

It also offers subscribers a choice of investment option devised after thorough market research and helps them diversify their savings in accordance with their risk appetite. The National Pension System (NPS) was launched in 2004 and is a defined contribution pension scheme, which enables small savings to accumulate on a tax exempt basis over a long period of time. NPS is meant for the salaried individuals of every income group and for all age groups.

A Unit Linked Insurance Plan is a combination of insurance and investment products that helps you accomplish your financial goals. These plans are based on traditional Life Insurance policies and hence offer life insurance coverage as well. In simple words, ULIPs are really lucrative investment options with a lot of benefits.

It’s a popular choice because it allows you to invest in funds, stocks and bonds without having to pick just one. There is also the flexibility aspect of being able to withdraw your money at any time during the tenure of the policy. ULIP or Unit Linked Insurance Plan is a long term investment plan and it insures you for life. Some of the insurance companies offer benefits like death cover, disability cover and pre-conditions cover. Assuming you are searching for a drawn out venture choice that consolidates protection and speculation? Then, at that point, ULIP could be your smartest option as one part of the top notch you pay goes towards getting your life, and the other piece is put into financial exchanges for producing returns. The profits can float around 8%, however since it puts resources into stocks, one can anticipate variances in its costs. In view of similar explanations, their premium and authoritative charges are additionally high.

One of the pressing problems faced by senior citizens is that of not having enough financial resources to support themselves during their old age. Those who have a family support system, especially children and grandchildren, may not face this problem.

However, there are those who spend their lives with one partner and are dependent on them for financial help in the time of need. Even if they do have children or additional support, seniors also need long term income sources which can help them in living comfortably through old-age. One such investment facility they can choose is the Senior Citizens’ Savings Scheme (SCSS). An investment in the Senior Citizens’ Savings Scheme is a safe way to secure your future with the safety of a fixed income year after year. The maximum amount of 15 Lakh can be invested in this scheme.

When one thinks of investment, the first options that come to mind are stock, real estate, and bonds. While these options can provide financial security, their risks need to be understood and considered. For many investors gold is a better choice for their investment portfolio.

It’s a good idea to diversify your investments, and there are certain scenarios in which we recommend using gold as an investment or part of a portfolio. If you’re looking to purchase gold, one of the most common choices is a Gold Exchange-Traded Fund. However, Gold ETFs can seem a bit daunting due to their complicated tax structures and paperwork.

If you’re looking to buy gold then what better way than to buy it directly. Direct purchase offers you a great opportunity to check the quality and also ensure that your gold is delivered safely. If you are interested in buying gold but do not know where or how to start, a direct purchase may be your best option.

Post Office Savings Schemes have various schemes to invest your money. This type of investment is appealing to most prospective investors because it offers a high degree of safety and the possibility of higher returns than those offered by conventional investments such as bank deposits.

Like banks, there are different funds plans presented by the postal offices and are liked by numerous these days because of the security. Some of the renowned plans are the Kisan Vikas Patra, Sukanya Samriddhi Yojana, 5-year senior citizen savings scheme, National savings certificate, etc., and so on.

Stocks are one of the most popular types of investment because they are traded on exchanges. This means that their prices can be monitored and they can also be sold at any time so that investors can get some money back if they wish to. Like most kinds of investment, stocks come with risks and rewards so it is important for the investor to evaluate their risk capacity before investing, and to do proper research on companies and the market as a whole to determine if an investment is suitable for them. Stocks are one of the highest returns providing assets.

You can invest in the best stocks through Multibaggers.co.in, SEBI Registered advisory for getting good returns in the long term through different packages. We also provide technical analysis course to learn more about stocks.