-

SEBI Registered RA (INH000003507)

BSE Enlistment No:5203 - +91 9825663123

- support@abjfinstocks.com

Don’t Dare to Enter in Stock Trading without Reading this! Here you will lern all about stock market

Situations we face

1st situation: Trading in Stocks based on News about companies

We buy the stocks when positive news comes in

OR

We sell stocks with negative news

2nd situation: Trading in Stocks based on Fundamentals of companies

We buy stocks with good profits in books of companies thinking we will build profit in it.

OR

We don’t invest in loss making companies, thinking we will make loss in it but prices rise by 500-1000% then slowly company starts showing profits in the books.

But do we make profits trading this way?

No, we don’t…

Logically, we do right

i.e. Positive news must increase Stock Prices

OR

Good Profits making Companies must give Stock Prices Rise

but what happens we all know….

So, are fundamentals all bullshit???

No… Warren buffet and many other invests on fundamentals only and make huge wealth.

To understand why this happens first we need to understand

What is Stock Market?

Let’s Answer it..

What Everyone knows?

Theoretically, through Stock Market route participants get part Ownership in the business of Company and the Share of ownership depends on the proportion of holding. So, to earn the returns of business, in absence of having our own business, we can own Stocks.

But, is it really true?

If yes?

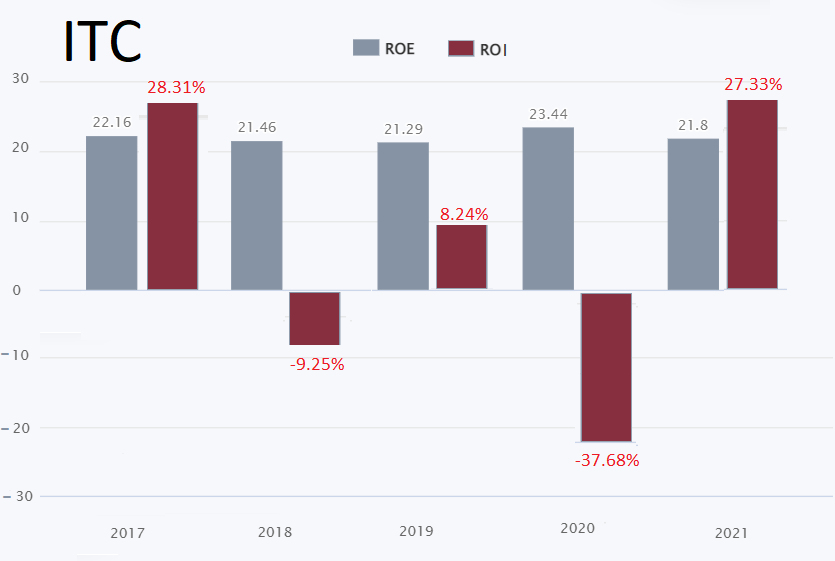

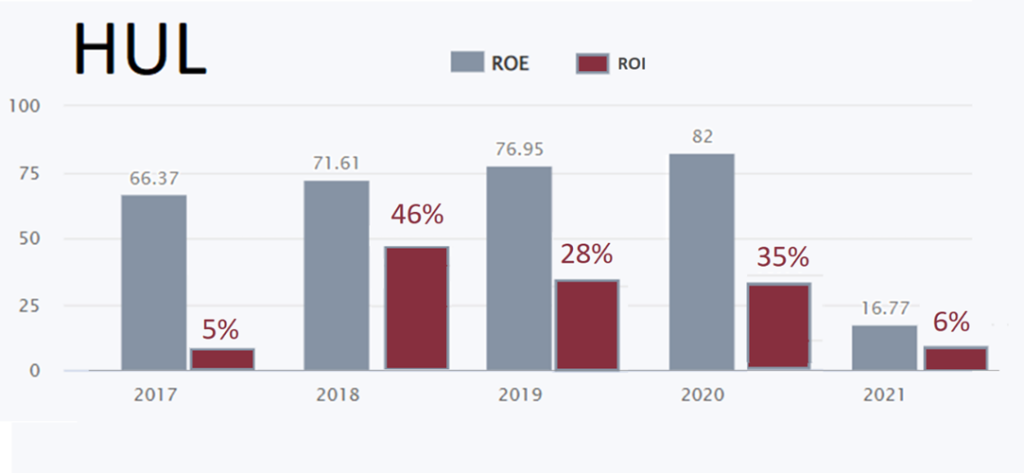

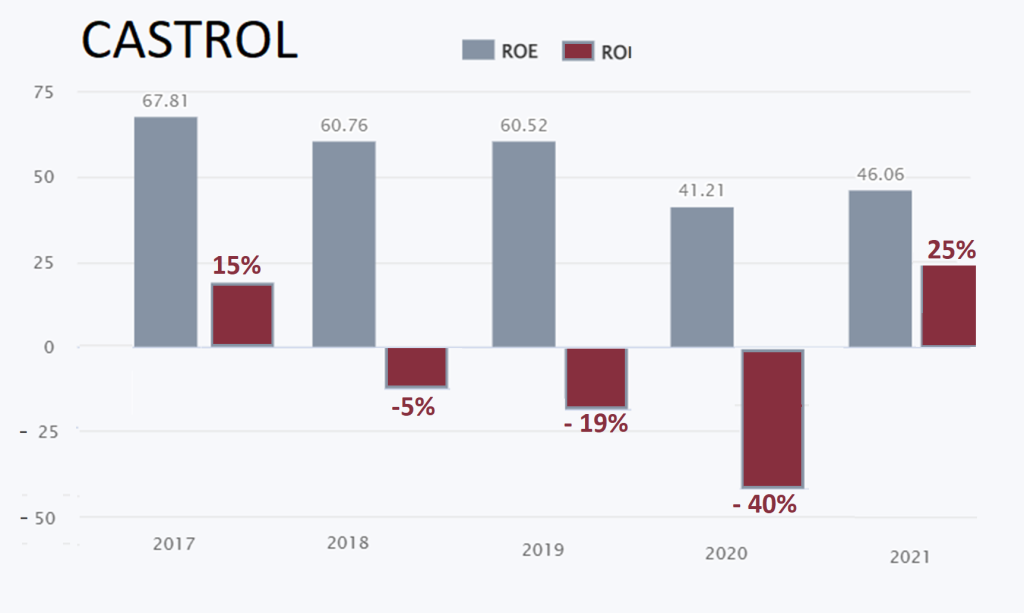

Then ROE must be same as ROI

ROE means profit, made by the company through its business, for shareholders in the books of company.

ROI means Profit actually made by shareholders in the stocks, of the said business for the given duration.

But does this happen?

Here we have mentioned few examples of the same:

An

A stock is a part ownership only n only if you have the idea to hold it till perpetuity for the purpose for which it was originally issued. Bonds are redeemable but stocks are not. But still, we redeem our stocks not to company but generally to other people through stock exchanges.

That is, we do trade in the stocks which was issued in Primary Market for the purpose of ownership but in secondary market we trade in these stocks. Business list on stock Market so Stock Market is a derivative in the sense it has underlying. Derivatives derives its value from something else. Here underlying for stock is business of company from which stock derives its value.

Options are also derivatives that derives its value from underlying stock, index, etc. Here I am mentioning options because we all know Options that is also derivative generally doesn’t replicate the move of underlying or in other words it doesn’t give the mirror returns as the underlying. Sometimes the returns on the Stocks can be greater than business and sometimes lesser than actual returns of business, many times it be reverse even.

So, what should be done under such situation?

Does Stock Trading is all Speculation then?

You need to be very clear about your Goal before entering in Stock Market.

If you are entering for few years or any time frame below it then fundamental analysis is not the key to success.

For trading purposes, we don’t need to look how the news would be affecting companies’ profits or future cash flows and so how stock Prices would behave. Stock Prices has no relation with business of companies at least in shorter time.

You need to understand the price behaviour of it. Yes Price, Stock Price. In stock trading we don’t have intention to be owner of the owner but we want of take the benefit of price behaviour. Price behaviour cannot be understood through Fundamentals.

Fundamentals talks about Valuation and not prices. A stock can remain under-priced or overpriced for n number of years.

One of the best methods to understand price behaviour and to make money from Stock Trading is Technical Analysis. Technical Analysis should be focused upon for short term Trading purposes and not news or fundamentals of companies.

Anything near decades investment time frame is long term investment and not ownership of company for returns of business. To get returns in long term we need to consider many other things other than just Fundamentals of company like Technical Analysis, Smart Money, etc..

Technical Analysis works mind blowing even for long-term time frame investments.

Our Multibagger Stocks advise is a long-term investment and it is a secret Method based on fundamental, technical and Smart Money.

ABJ Finstocks is the SEBI Registered Stocks advisory providing long term investment calls, short term trading and intraday tips. Short term and intraday trading tips include Nifty, Bank Nifty and Stocks and it is solely based on Technical Analysis.

News Traps us and to stay protected catch out and follow only the price behaviour. Technical Analysis is a deep subject and need to mastered upon which takes years of hard work to go on. You can handover the work to expert for safe and profitable trading.