-

SEBI Registered RA (INH000003507)

BSE Enlistment No:5203 - +91 9825663123

- support@abjfinstocks.com

The place

to build a

Growing

portfolio.

The place to build a multi-million portfolio.

The place to generate multi-x money.

The place

to generate

Profits.

The place to

build a

multi-million portfolio.

The place to

generate multi-x

money.

SEBI Registered Since 2016 with Zero Complains by our clients

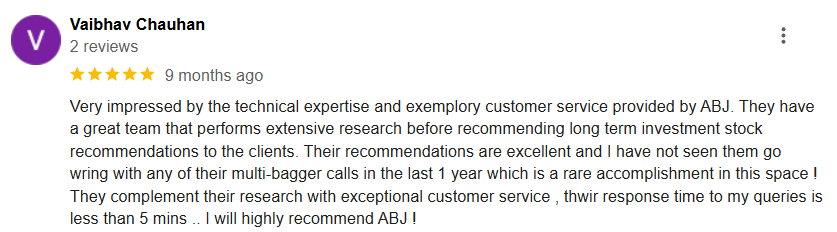

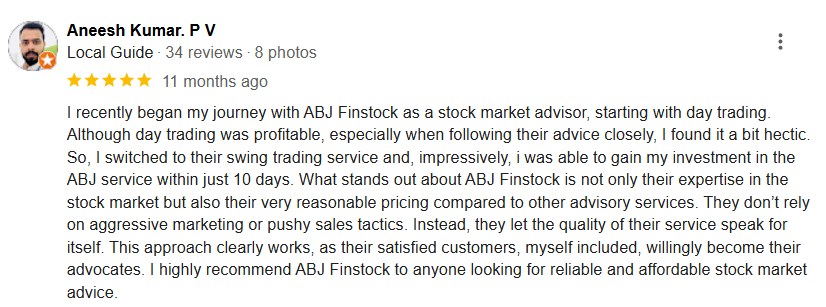

Welcome to ABJ Finstocks, your trusted partner for insightful stock recommendations, market analysis, and portfolio management services. ABJ Finstocks is a SEBI registered research analyst who recommends stocks for investment and trading. As a SEBI registered research analyst, we pride ourselves on our expertise, transparency, and client-centric approach, guiding you through the complexities of financial markets with integrity and personalized support. Explore our range of services

Investment for Min. 3-5 Years

Calls Ranging From 2 Days to 1 Year

Position Squared off Same Day

SEBI Registered Research Analyst since 2016.

Trading & Investing Since 2007

Proper Analysis: Calls Provided on Technical + Fundamental Analysis

Money Mgt. the success key for Investment & Trading: Our Clients work with it

You can check on SEBI website

You can check on SEBI website

ABJ Finstocks is a Sebi Registered Research Analyst, got Registered as Research Analyst since 2016.

Our Stock Research Analysts spends great time on market research after which recommends you the few stocks out of hundreds of stocks listed for your trading as well as investment. We are Equities Research Analyst and we even provide Calls in Index Derivatives Segment of Indian Stock Market.

We are one of the Sebi Registered Research Analyst in India. There are many websites that help investors and traders to do their own Research & Analysis but once become the part of ABJ Finstocks you will be no more required to be in the stress of taking the decision in dynamic Stock Market. We will recommend you the well studied stocks for investment and trading out of the thousands of listed stocks in India Stock Market.

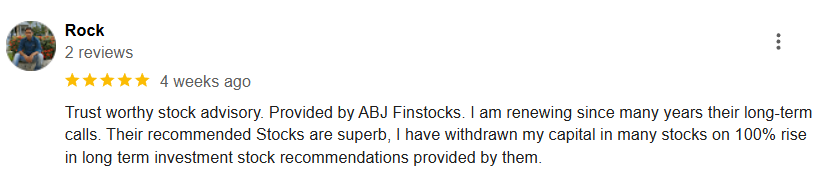

We don’t claim to be one of the best Stock Recommendation websites but our recommended Investment’s portfolio performance speaks about our work in Stock Market. Do contact us to know and understand the things in detail.

Associate Now, with ABJ Finstocks to achieve your financial Goals and to know where to Park your money in stocks for long term and trade in short term.

Keep yourself updated with why’s & how’s of the invested world.