-

SEBI Registered RA (INH000003507)

BSE Enlistment No:5203 - +91 9825663123

- support@abjfinstocks.com

Difference Between Multibagger and Penny Stocks

Whether you are a newbie contemplating entering the world of investing, or a seasoned stock market professional, the one thing all of us are looking for is the right stocks to invest. Should I invest in cheap stocks or should I pick stocks that have proven their worth in the market?

In this blog let us first understand Multibagger stocks and Penny stocks. Before we tell you which one should you choose – multibagger or penny stocks, let’s first understand what are multibagger stocks and penny stocks (Packages by ABJ Finstocks).

Multibagger Stocks: These are stocks that have the potential to increase significantly in value, often delivering returns that are multiple times the initial investment. They have the potential to double in a year and give up to 1000% returns in few years.

Penny Stocks: These are stocks that have very low market cap. Most are them are not featured in the Index or the Future & Options category. These are small, emerging companies or those with lower market capitalizations. Due to their small market cap, they are highly speculative and volatile, with the potential for significant gains or losses. Finding good stocks in such category is a tedious and specialised task.

Often we come across the financial terms, Multibagger Stocks and Penny Stocks. Let’s get well verse with both the term’s similarities and dis-similarities.

Though there are no specific definitions, Multibagger Stocks and Multibagger Penny Stocks are investment jargons which are used by market participants to describe equity stocks which has potential to give multiple times return. According to layman, 100% return is defined as a single bagger; likewise two baggers give 200% returns.

These stocks possess the power of exponential growth rate in their sales, revenue and so the profits which make them deliver multibagger returns. Market share of these stocks are low.

Then which factors make these stocks differ???

Growth and Fundamentals:

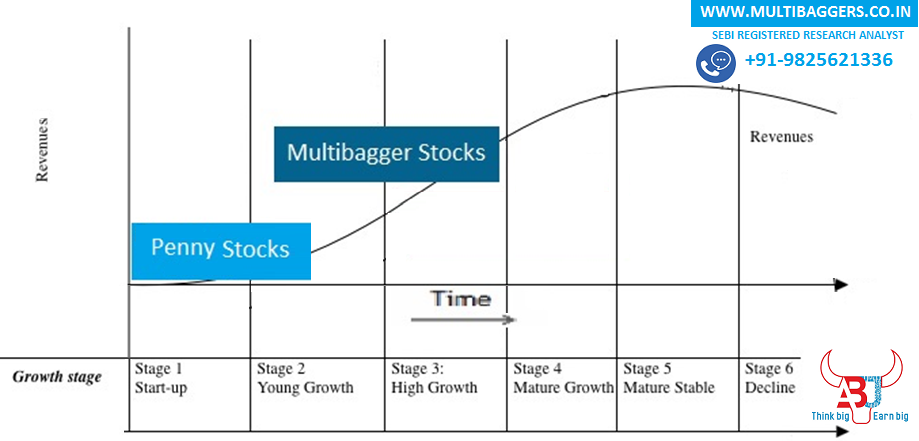

Multibagger Stocks are growth stocks as they are high growth companies that already crossed the barrier those letdown startups whereas Penny stocks are generally in startup phase or about to enter high growth phase so more riskier than Multibagger Stocks, usually Venture Capitalist invests in such companies. Though the success ratio of multibagger returns is more in case of Multibagger stocks as compared to Penny stocks as Multibagger Stocks has good fundamentals as compared to Penny Stocks.

Market Capitalization:

Multibagger stocks are small cap stocks and Mid Cap stocks contrarily Penny stocks are Micro cap stocks, price of Penny stocks are generally below Rs.50-100.

Liquidity:

Multibagger stocks broadly have good liquidity whereas Penny stocks have low liquidity because of low Volumes and Market-Cap, this makes Penny stocks are highly momentum stocks since it’s easy to manipulate low capital stocks.

Risk & Return:

Multibagger stocks are safer than penny stocks. Penny stocks are highest risk and fastest returns, in other words Penny stocks are like multibagger returns in comparatively shorter term. It’s just like buying options either you earn multiple returns or you may lose your capital even as it may not give chance to exit even, due to seller circuit or delisting. So Penny stocks are advisable only for investors with lot of surplus money or allocate only small proportion of your portfolio in Penny stocks. In penny stocks best thing is, good diversification is possible even with small fund.

Which is better?

ABJ provides stocks advisory services in both Multibagger Stocks and Penny stocks but Investment in Multibagger Stocks is preferable for long term as compared to Penny stocks. Penny stocks do rise but winning probability in Multibagger stocks is 6 out of 10 and 2 out of 10 in Penny stocks for long term, as 8 out of 10 of Penny stocks don’t exist even, in long term. Penny stocks are like use and throw, it’s better to exit in such stocks on 5 times return but in Multibagger we don’t count returns even they give miraculous growth to wealth.

On risk side Penny stocks should be invested only if you are ready to loose capital if you cannot bear so much risk then Penny stocks are not made for you. Moe the risk more the returns as Penny stocks are riskier than Multibagger Socks they also have the tendency to give returns much more than Multibagger Stocks.

If market is bullish and you have few years’ time frame as investment horizon then Penny stocks returns are much more higher than Multibagger Stocks.

Now that you know what these stocks mean, let’s look at their advantages.

Advantages of Multibagger Stocks

Advantages of Penny Stocks

In our experience, we have seen that Multibagger stocks and Penny Stocks both rise like options without the risk of total loss. We have also seen that small-cap stocks give good returns while large-cap stocks hardly move. To enhance your average returns you have to invest in stocks with high growth potential. Most of these stocks may at least double your initial investment, with some becoming standout performers while others yield average results.

Having said all this, we know you are still wondering which one to choose, right? Whether it is multibaggers or penny stocks, finding these stocks is a specialised task. With over 4500 stocks in the market, you need an expert stock advisory services to choose them for you. This is where we, ABJ Finstocks, can play a big role by recommending the stocks that can help you enhance your wealth.