-

SEBI Registered RA (INH000003507)

BSE Enlistment No:5203 - +91 9825663123

- support@abjfinstocks.com

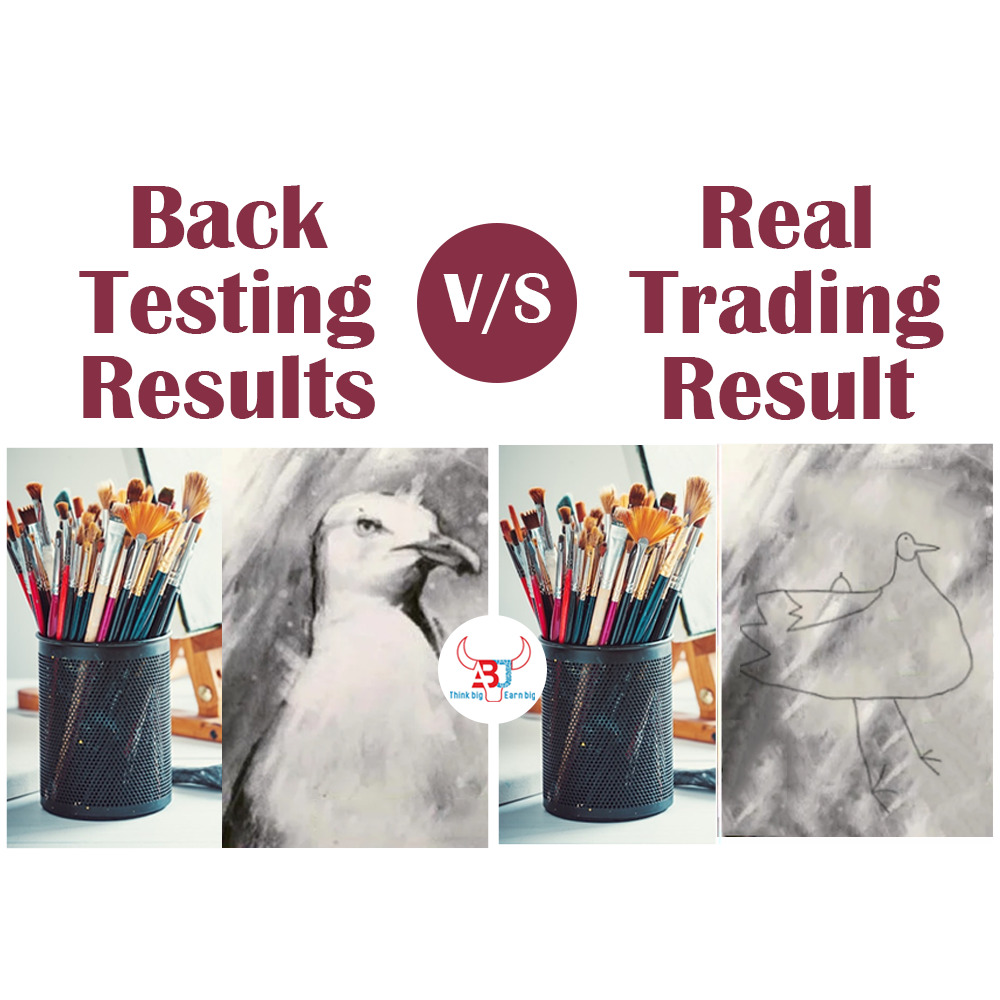

In this article we have explain the difference in results of Actual Trading v/s back Testing

Backtesting is analyzing historical actual price moves on charts, how we would have traded there. Backtesting (Paper trading) is a type of trading that does not involve the use of real money.

Backtesting is one of the most important methods to develop and check a trading strategy. If created and interpreted properly, it can help traders improve and master their strategies. Backtesting helps find any flaws, as well as gain confidence in their strategy before applying it to the real-world markets.

Steps to do Backtesting

You’ll suffer from a look-ahead bias that will twist your results (this means you know ahead of time what happens on the charts which affect your current backtesting trading decisions). So, select the software that hides future price moves from the point of backtesting.

If you don’t want to put yourself in the tough job of making trading strategies to, get the right entries and exit you can contact us for share market tips to trade In Index and stocks to buy for the short term.

Limitation of Backtesting

It is an observation that the results of many trading strategies are very good on backtesting but when that strategy is applied for actual trading, results generally underperform the backtesting results. In fact, it may never overperform but chances are very high it underperforms, and sometimes the profit-making back-tested trading strategy gives the loss in real trading.

Reasons: In backtesting No-Risk so No Stress. Paper trading benefits but the process has limitations because it dismisses the impact of emotional reactions in a typical market day. Backtesting costs nothing, and you can’t lose money. Trading evokes the twin emotions of greed and fear. Paper trading bypasses the emotional roller coaster, so the new participant can focus fully on the mathematical process of trading strategy, but trading is much more than just Maths, it involves Psychology which has more than 60% contribution to trading success.

We at multibaggers.co.in teach Successful trader course which covers all the three aspects of trading i.e. Trading Strategy + Money Management + Psychology for making a successful trading career as a trader, you can join our stock market courses online or offline.

Conclusion

After finalizing the strategy by backtesting you need to practice money management and Psychology which was never required in backtesting but plays a huge role in the real market.